Whilst intentional reflection may happen at the end or beginning of a year or personal growth journey, unintentional reflection happens all the time. And, we barely notice it, most of the time. But, several times a week, if not several times a day, we measure ourselves against something or someone; we’re either measuring ourselves against others or ourselves.

Whether consciously or unconsciously, we set benchmarks all the time. It’s how we discern how well we’re doing, and we can either set internal or external benchmarks. There’s a place for both, but it’s important to start to acknowledge where we’re dropping our anchor. Like a boat on the ocean, we can’t healthily remain anchored in one place all the time, but there are good times and places to drop anchor between floating or sailing.

When it comes to setting benchmarks for growth, it’s often healthier to spend more time with our internal benchmarks and maybe use external benchmarks for lighter references. It’s almost like saying: Look where I am now (external) versus look how far I’ve come (internal).

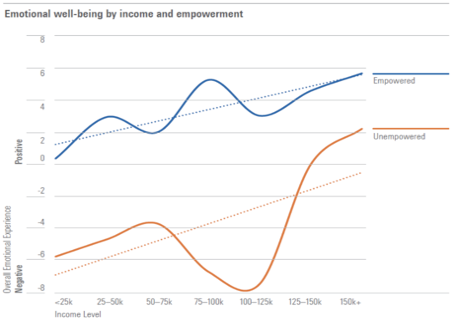

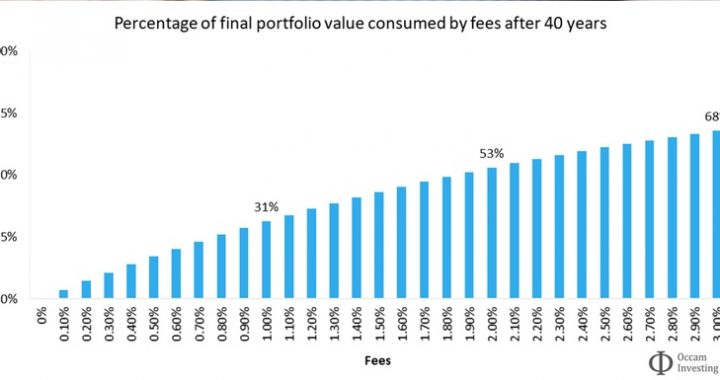

For someone like Elon Musk or Jeff Bezos, earning millions a year or selling a company for tens of millions is not really a big deal. But for most of us, it would be life-changing! Likewise, if we look at the performance in specific funds and compare it to the growth in our personal investment portfolio, we may not see a correlation. These are all external benchmarks that are easy to internalise and, if we anchor there, we may feel extremely disheartened in our reflection.

So, when we create a plan, we’re essentially creating a framework for internal benchmarks. These could relate to our financial situation, but they can also apply to every other area in life; personal relationship goals, studying, health, hobbies and community outreach. When we work on our internal benchmarks, it’s helpful to have reference to what’s going on in the world around us.

A poignant example of this is the COVID-19 pandemic that changed the world forever. If we had only considered our internal benchmarks and ignored what was going on externally, we would have felt enormous pressure to perform better. But bringing in the social, economic, political, and health issues of that event helps us to adjust and review our internal benchmarks in a relative context – and still be able to say, “Look how far I’ve come!”.

And, if we’d only anchored in external benchmarks, soley focussed on what was going on around us, we would have been completely overwhelmed. One of the reasons for this is that when we see the success of others, we only see the spotlight on the end achievements and don’t see the hard work, frustration, dissapointment and failed attempts that went in behind the scenes. We then assume that our own journey is not matching up.

If we want to measure our progress in a relatable and balanced manner, it’s important to understand the role of both internal and external benchmarks and learn to be comfortable with moving freely between the two.