Fund managers often tell us how they try and personalise their funds as this helps them when making certain decisions. They would often think of their grandparents or parents or close family friend and consider how decisions will impact them if they are the holder of the fund. So, when writing this article, we were faced with the same questions: ‘How are our parents, grandparents or siblings dealing with this sudden market crash?’ And, most important: ‘How are our clients perceiving the economic climate?’

The starting point is to provide some perspective as to what exactly happened. It is by pure chance that the coronavirus and the oil price crash overlapped and as these events coincided, it inflated the economic crisis. Furthermore, investors started to panic, and not only did we see a bulk buying of durable goods at our supermarkets, but also a panic sell-off in the stock markets.

Yes, it makes sense for a company like Sasol, which still earns a fair chunk of their income from oil, to crash when the oil price falls. Sasol has been busy with expensive projects in the USA and have incurred large amounts of debt over the last few years. Their oil business requires the oil price to trade at $35 a barrel or more in order to operate and repay debt.

There are typically two things that drive markets: fundamentals and sentiment.

With the frenzy of a global pandemic; factories closing; panic buying; fear of the unknown; small businesses forced to close temporarily, and travel bans, sentiment started to drive and fuel the sell-off we saw in the markets over the last few weeks. Adding to this, large economies started to see their central banks cut interest rates in order to assist with some money being pumped into the system. Normally this can spark a rally in the stock market, but markets initially didn’t respond positively to this news and interpreted these extreme measures from central banks as an indication that things are worse than expected. This pushed the markets down even further.

So, knowing some of the reasons behind what has been driving market negativity, investors are now faced with a very difficult decision: Do I disinvest or stay put?

The answer to this question isn’t as simple as you’d hope. You see, each investor is invested for a different life goal and for a different investment period and it will thus depend on many variables. It therefore isn’t a simple yes or no.

In a perfect world it would be great to know the following before we make a decision:

- Could markets go further down?

- When will markets recover?

- Is now a good time to cut my losses?

There are so many variables in the market that it is impossible to answer any of these questions without some sort of caveat or fine print.

If you were planning to retire:

Well, maybe give this a second thought. Unless you’ve reached retirement age and are forced to do so, you could reconsider and postpone your retirement. Many pension funds had exposure to the likes of Sasol and other shares, and your retirement capital could be less. Given that the bottom of this market crash is uncertain, postponing retirement could provide an opportunity for pension funds to recover, increasing the capital available with which to buy a pension income.

You’ve recently retired:

As wealth planners we have seen previous market corrections and more harsh market crashes. This is also why we draft investment plans for our clients first and trust they will stay the course and stick to the plan. As wealth planners we also believe in diversifying clients’ portfolios. As an investor you can opt to invest in many asset classes such as money markets, credit instruments, equities, property and bonds. When we look at the returns of these asset classes since 1 January to 17 March 2020, it shows that not all asset classes have reacted similarly and when blending different asset classes, you could potentially reduce the severity of a market crash on your portfolio.

As wealth planners we have seen previous market corrections and more harsh market crashes. This is also why we draft investment plans for our clients first and trust they will stay the course and stick to the plan. As wealth planners we also believe in diversifying clients’ portfolios. As an investor you can opt to invest in many asset classes such as money markets, credit instruments, equities, property and bonds. When we look at the returns of these asset classes since 1 January to 17 March 2020, it shows that not all asset classes have reacted similarly and when blending different asset classes, you could potentially reduce the severity of a market crash on your portfolio.

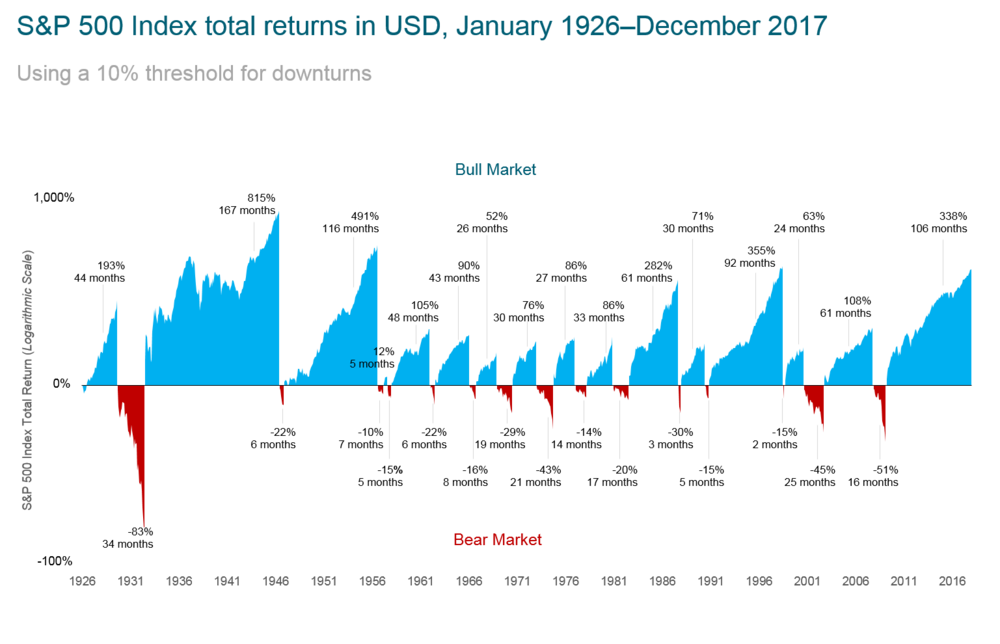

What we have often seen is that once the panic dissipates, markets tend to recover quickly and investors who switched to safe-haven assets incur permanent losses on their portfolios that are seldom recovered. They would have been better off had they stayed in the market regardless of their anxiety.

You are fully invested:

If you were fully invested in equities, then switching to cash, as mentioned above, could mean permanently eroding the capital. Again, if you had a crystal ball and could say with absolute surety that the markets would go to 0, then I would agree that you cut your losses and try to save the bit you have left. However, if you have no surety as to where the bottom of this crash is, you also have no means of timing the recovery. Evidence shows that making no changes are often more effective than reacting on the sentiment and market noise. Answering questions such as: ‘Should I cut my losses?’, ‘Can it get worse?’ and ‘When will things get better?’, lead to emotionally driven decisions. It is often useful to learn from history and we do not have to look too far in the past to get such an example. In the 2008 great financial crisis, if you invested R100 in the JSE on 1 January 2007 and disinvested your money 31 December 2008, you would have cashed out R91.50. If you then decided to reinvest this back into the market on, let’s say, on 1 June 2009, your value as at 31 December 2019 would have been R311.80. However, if you didn’t disinvest and stayed put right through until 31 December 2019, your end value would have been R336.60. There might have been perfect market timers whose results would differ, but the calculation illustrates that missing the best days in the market or timing it just slightly wrong could have a worse outcome than staying invested.

You have money to invest:

You are very fortunate to be in this position. The world, as incredibly chaotic as it may seem, is offering you so much potential in terms of investments opportunities. For the first time we are seeing the shares of large companies offering good value. Although novice investors should take note that not all things that are cheap have value, there are good quality companies that present buying opportunities that haven’t been seen in a long time.

Bonds could also unlock great value, as the current valuations are attractive. When bond yields are high, their prices are low. This means that if you buy bonds at the current levels, you are buying a good interest income for years to come. It also presents the opportunity that a capital gain can be earned, as it is expected in times like these that interest rates will be reduced. As interest rates come down, bond prices tend to increase, leading to capital appreciation. Yields have recently picked up to levels last seen in 2008, and this could be a great opportunity for investors.

It is thus important to evaluate your own situation as an investor. Try to avoid following the herd. Consider what news really impacts you. When you see the headlines reading ‘JSE lost 22% since the start of the year’, it doesn’t mean every equity fund lost this amount and it doesn’t necessarily mean your wealth is down with 22%. Fund managers also diversify, and they make use of very complex instruments such as hedges to protect against such losses. As an example, whilst the JSE retracted by 22% over the last few months, some general equity funds lost only 7%.

Consider the silver lining as well. As interest rates are being cut, debt repayment becomes more affordable, and while Sasol (and most of the analysts and wealth planners out there) could not have foreseen the sudden price war of oil, this too brings some relief as petrol prices will come down in April. This could assist in reducing inflation in months to come.

The key takeaway from this article is to always analyse your own situation before reacting on the market noise and market news.

- Consider your time horizon. If you are a longer-term investor then avoid being short sighted during this time.

- Don’t get wrapped up in the bad news. Distinguish between noise and news.

- Make sure you understand the numbers.

- Stay the course if you have an investment plan. Your investment plan is tailored to your needs, wants, goals and time horizon.

- Don’t try and time the market. If you are planning to invest for a goal or a certain investment horizon, now is as good a time as ever. Time in the market is more important than timing the market.

- Diversify your portfolio.

- Don’t be fooled now in these panic times by schemes promising to deliver double digit guarantees. Remember that during these times we meet the bitcoins, Sharemax and fixed deposit businesses that disappear as quickly as they appear (with your hard-earned money).

As a final thought, it is best to consider that we live in different times and not all pandemics end the same way. Not all pandemics are equal, and some last longer or are more devastating. We should also note not all economic crises are the same and that even the recovery of the markets might take longer or shorter, and it might come just as quick as the sudden shocks.

What you could potentially do as an investor (private, professional or institutional), is consider your way of doing: Perhaps work longer, consider alternative means of generating income, review your budget, and finally, while the world is facing a global lockdown, be safe and considerate of your neighbour.

Keep a social distance and remain calm.

As wealth planners we have seen previous market corrections and more harsh market crashes. This is also why we draft investment plans for our clients first and trust they will stay the course and stick to the plan. As wealth planners we also believe in diversifying clients’ portfolios. As an investor you can opt to invest in many asset classes such as money markets, credit instruments, equities, property and bonds. When we look at the returns of these asset classes since 1 January to 17 March 2020, it shows that not all asset classes have reacted similarly and when blending different asset classes, you could potentially reduce the severity of a market crash on your portfolio.

As wealth planners we have seen previous market corrections and more harsh market crashes. This is also why we draft investment plans for our clients first and trust they will stay the course and stick to the plan. As wealth planners we also believe in diversifying clients’ portfolios. As an investor you can opt to invest in many asset classes such as money markets, credit instruments, equities, property and bonds. When we look at the returns of these asset classes since 1 January to 17 March 2020, it shows that not all asset classes have reacted similarly and when blending different asset classes, you could potentially reduce the severity of a market crash on your portfolio.